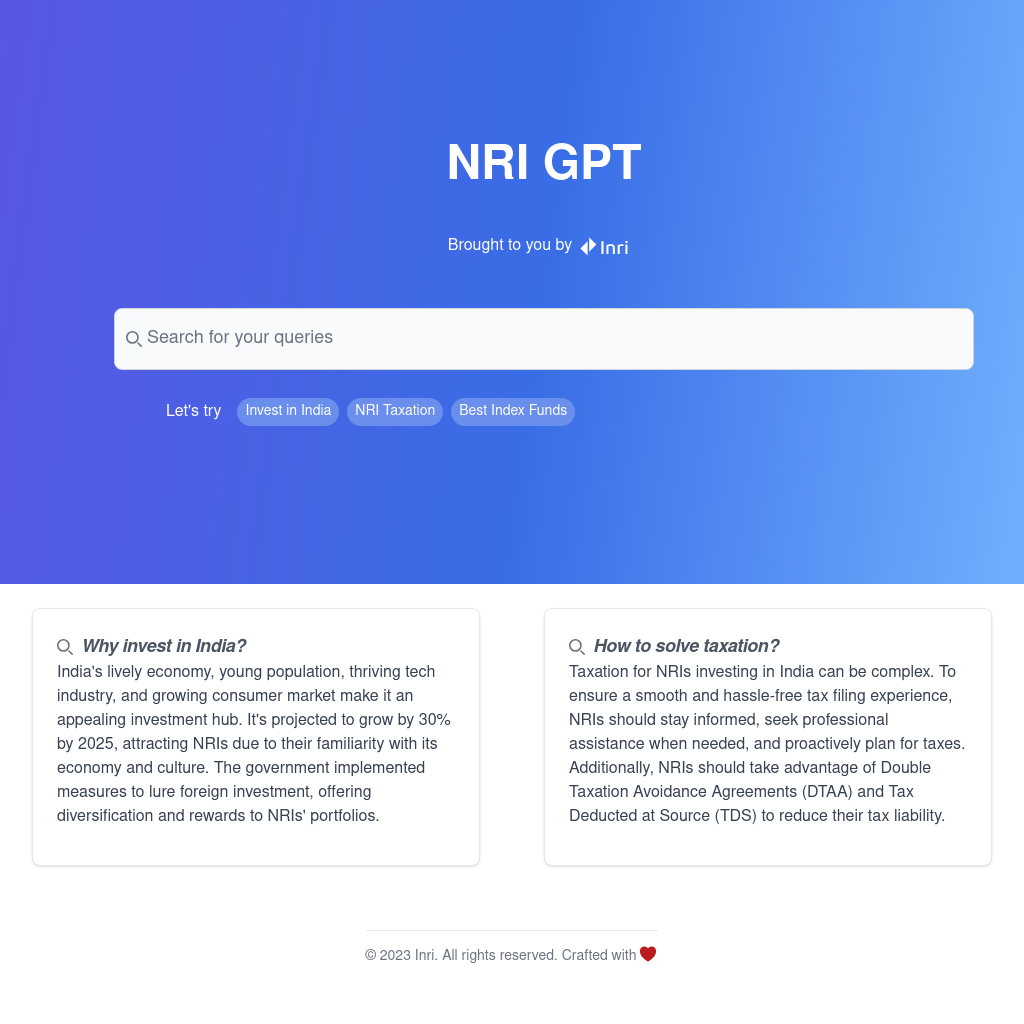

What is NRI GPT

India's dynamic economy, young population, and growing tech industry make it an attractive destination for investments. With a projected growth of 30% by 2025, NRIs are drawn to the country due to their familiarity with its economy and culture. The government has implemented measures to attract foreign investment, offering diversification and potential rewards to NRI portfolios.

How to Use NRI GPT

NRIs interested in investing in India should stay informed about taxation policies, seek professional assistance for tax filing, and proactively plan for taxes. Utilizing Double Taxation Avoidance Agreements (DTAA) and Tax Deducted at Source (TDS) can help reduce tax liabilities.

Use Cases of NRI GPT

This guide is designed for NRIs looking to invest in India, providing insights into the economic landscape, taxation policies, and strategies to optimize investment returns.

Features of NRI GPT

-

Economic Growth

India's economy is projected to grow by 30% by 2025, offering significant investment opportunities.

-

Government Incentives

The Indian government has implemented measures to attract foreign investment, benefiting NRIs.

-

Taxation Strategies

NRIs can utilize DTAA and TDS to minimize tax liabilities and ensure a smooth tax filing process.